Eliminate Risk of Failure with PRMIA 8010 Exam Dumps

Schedule your time wisely to provide yourself sufficient time each day to prepare for the PRMIA 8010 exam. Make time each day to study in a quiet place, as you'll need to thoroughly cover the material for the Operational Risk Manager (ORM) Exam . Our actual Operational Risk Management exam dumps help you in your preparation. Prepare for the PRMIA 8010 exam with our 8010 dumps every day if you want to succeed on your first try.

All Study Materials

Instant Downloads

24/7 costomer support

Satisfaction Guaranteed

Financial institutions need to take volatility clustering into account:

1. To avoid taking on an undesirable level of risk

2. To know the right level of capital they need to hold

3. To meet regulatory requirements

4. To account for mean reversion in returns

See the explanation below.

Volatility clustering leads to levels of current volatility that can be significantly different from long run averages. When volatility is running high, institutions need to shed risk, and when it is running low, they can afford to increase returns by taking on more risk for a given amount of capital. An institution's response to changes in volatility can be either to adjust risk, or capital, or both. Accounting for volatility clustering helps institutions manage their risk and capital and therefore statements I and II are correct.

Regulatory requirements do not require volatility clustering to be taken into account (at least not yet). Therefore statement III is not correct, and neither is IV which is completely unrelated to volatility clustering.

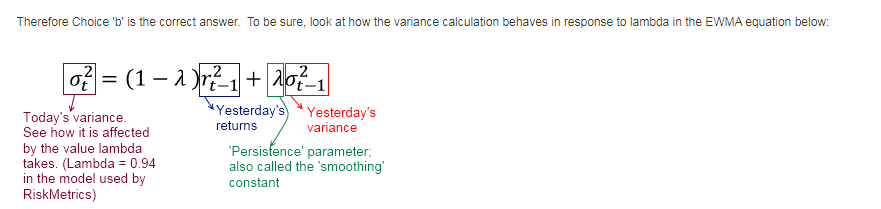

As the persistence parameter under EWMA is lowered, which of the following would be true:

See the explanation below.

The persistence parameter, , is the coefficient of the prior day's variance in EWMA calculations. A higher value of the persistence parameter tends to 'persist' the prior value of variance for longer. Consider an extreme example - if the persistence parameter is equal to 1, the variance under EWMA will never change in response to returns.

1 - is the coefficient of recent market returns. As is lowered, 1 - increases, giving a greater weight to recent market returns or shocks. Therefore, as is lowered, the model will react faster to market shocks and give higher weights to recent returns, and at the same time reduce the weight on prior variance which will tend to persist for a shorter period.

Which of the following is not a limitation of the univariate Gaussian model to capture the codependence structure between risk factros used for VaR calculations?

See the explanation below.

In the univariate Gaussian model, each risk factor is modeled separately independent of the others, and the dependence between the risk factors is captured by the covariance matrix (or its equivalent combination of the correlation matrix and the variance matrix). Risk factors could include interest rates of different tenors, different equity market levels etc.

While this is a simple enough model, it has a number of limitations.

First, it fails to fit to the empirical distributions of risk factors, notably their fat tails and skewness. Second, a single covariance matrix is insufficient to describe the fine codependence structure among risk factors as non-linear dependencies or tail correlations are not captured. Third, determining the covariance matrix becomes an extremely difficult task as the number of risk factors increases. The number of covariances increases by the square of the number of variables.

But an inability to capture linear relationships between the factors is not one of the limitations of the univariate Gaussian approach - in fact it is able to do that quite nicely with covariances.

A way to address these limitations is to consider joint distributions of the risk factors that capture the dynamic relationships between the risk factors, and that correlation is not a static number across an entire range of outcomes, but the risk factors can behave differently with each other at different intersection points.

Which of the following are considered properties of a 'coherent' risk measure:

1. Monotonicity

2. Homogeneity

3. Translation Invariance

4. Sub-additivity

See the explanation below.

All of the properties described are the properties of a 'coherent' risk measure.

Monotonicity means that if a portfolio's future value is expected to be greater than that of another portfolio, its risk should be lower than that of the other portfolio. For example, if the expected return of an asset (or portfolio) is greater than that of another, the first asset must have a lower risk than the other. Another example: between two options if the first has a strike price lower than the second, then the first option will always have a lower risk if all other parameters are the same. VaR satisfies this property.

Homogeneity is easiest explained by an example: if you double the size of a portfolio, the risk doubles. The linear scaling property of a risk measure is called homogeneity. VaR satisfies this property.

Translation invariance means adding riskless assets to a portfolio reduces total risk. So if cash (which has zero standard deviation and zero correlation with other assets) is added to a portfolio, the risk goes down. A risk measure should satisfy this property, and VaR does.

Sub-additivity means that the total risk for a portfolio should be less than the sum of its parts. This is a property that VaR satisfies most of the time, but not always. As an example, VaR may not be sub-additive for portfolios that have assets with discontinuous payoffs close to the VaR cutoff quantile.

The largest 10 losses over a 250 day observation period are as follows. Calculate the expected shortfall at a 98% confidence level:

20m

19m

19m

17m

16m

13m

11m

10m

9m

9m

See the explanation below.

For a dataset with 250 observations, the top 2% of the losses will be the top 5 observations. Expected shortfall is the average of the losses beyond the VaR threshold. Therefore the correct answer is (20 + 19 + 19 + 17 + 16)/5 = 18.2m .

Note that Expected Shortfall is also called conditional VaR (cVaR), Expected Tail Loss and Tail average.

Are You Looking for More Updated and Actual PRMIA 8010 Exam Questions?

If you want a more premium set of actual PRMIA 8010 Exam Questions then you can get them at the most affordable price. Premium Operational Risk Management exam questions are based on the official syllabus of the PRMIA 8010 exam. They also have a high probability of coming up in the actual Operational Risk Manager (ORM) Exam .

You will also get free updates for 90 days with our premium PRMIA 8010 exam. If there is a change in the syllabus of PRMIA 8010 exam our subject matter experts always update it accordingly.