Eliminate Risk of Failure with CIMAPRA19-F03-1 Exam Dumps

Schedule your time wisely to provide yourself sufficient time each day to prepare for the CIMAPRA19-F03-1 exam. Make time each day to study in a quiet place, as you'll need to thoroughly cover the material for the F3 Financial Strategy exam. Our actual CIMA Professional Qualification exam dumps help you in your preparation. Prepare for the CIMAPRA19-F03-1 exam with our CIMAPRA19-F03-1 dumps every day if you want to succeed on your first try.

All Study Materials

Instant Downloads

24/7 costomer support

Satisfaction Guaranteed

NNN is a company financed by both equity and debt. The directors of NNN wish to calculate a valuation of the company's equity and at a recent board meeting discussed various methods of business valuation.

Which THREE of the following are appropriate methods for the directors of NNN to use in this instance?

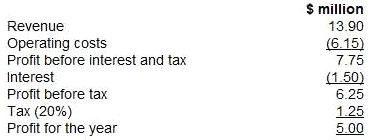

A financial services company reported the following results in its most recent accounting period:

The company has an objective to achieve 5% earnings growth each year. The directors are discussing how this objective might be achieved next year.

Revenues have been flat over the last couple of years as the company has faced difficult trading conditions. Revenue is expected to stay constant in the coming year and so the directors are focussing efforts on reducing costs in an attempt to achieve earnings growth next year.

Interest costs will not change because the company's borrowings are subject to a fixed rate of interest.

What operating profit margin will the company have to achieve next year in order to just achieve its 5% earnings growth objective'?

The Government of Eastland is concerned that competition within its private healthcare industry is being distorted by the dominant position of the market leader, Delta Care. The Government has instructed the industry regulator to investigate whether the industry is operating fairly in the interests of patients.

Which of the following factors might the industry regulator review as part of their investigation?

Select ALL that apply.

Which TWO of the following statements about debt instruments are correct?

An unlisted software development business is to be sold by its founders to a private equity house following the initial development of the software. The business has not yet made a profit but significant profits are expected for the next three years with only negligible profits thereafter. The business owns the freehold of the property from which it operates. However, it is the industry norm to lease property.

Which THREE of the following are limitations to the validity of using the Calculated Intangible Value (CIV) method for this business?

Are You Looking for More Updated and Actual CIMAPRA19-F03-1 Exam Questions?

If you want a more premium set of actual CIMAPRA19-F03-1 Exam Questions then you can get them at the most affordable price. Premium CIMA Professional Qualification exam questions are based on the official syllabus of the CIMAPRA19-F03-1 exam. They also have a high probability of coming up in the actual F3 Financial Strategy exam.

You will also get free updates for 90 days with our premium CIMAPRA19-F03-1 exam. If there is a change in the syllabus of CIMAPRA19-F03-1 exam our subject matter experts always update it accordingly.